WASHINGTON — President Joe Biden attempted to reassure Americans the banking systems “are safe” amid panic following the collapse of the Silicone Valley Bank last week, making it the second largest banking failure in U.S. history.

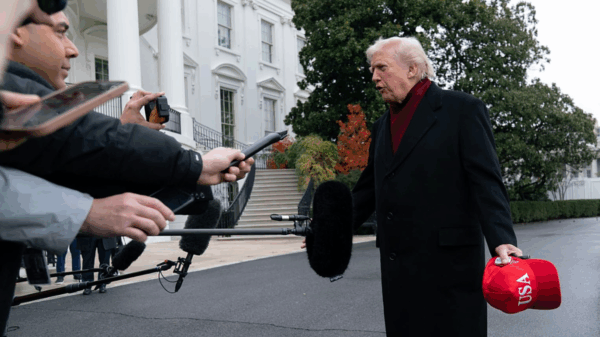

Speaking from the White House on Monday morning, Biden praised his administration for taking quick action to counter the uncertainties about the banking system and give confidence that the banking system is safe.

“Thanks to the quick action of my administration over the past few days, Americans can have confidence that the banking system is safe,” Biden said. “Your deposits will be there when you need them.”

The President said he gave his team instructions to protect all U.S. workers and small businesses, including detailed actions to protect customers’ deposits and not put taxpayer dollars at risk, to hold those for the collapse responsible, and not to protect investors in the bank. Biden added the management of Silicon Valley Bank and Signature Bank would be fired.

“If the bank is taken over by FDIC, the people running the bank should not work there anymore,” he said.

Biden vowed to a “full accounting” of what led to the shutdown of Silicon Valley Bank.

“In my administration, no one is above the law. And finally, I must reduce the risk of this happening again,” he said.

Sunday evening, Biden released a statement saying he directed Treasury Secretary Janet Yellen and National Economic Director Lael Brainard to “work diligently” with the banking regulators to address problems at Silicon Valley Bank. The U.S. Treasury, the Federal Reserve and the Federal Deposit Insurance Corp. said the government would support deposits beyond the federally insured ceiling of $250,000.

“Depositors will have access to all of their money starting Monday, March 13,” the agencies said in a joint statement Sunday evening. “No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

The Biden administration held a meeting with senators Sunday to go over the situation but some Senate Republicans on the Banking Committee claimed they didn’t get invited.

“It is unacceptable that Senate Republicans were excluded from Treasury’s briefing to Congress this evening. The lack of transparency & responsiveness from the Biden administration has been galling,” the committee GOP tweeted. “The administration has the responsibility to keep ALL members updated in real time.”